amazon flex driver tax forms

Service income to US. If your payment is 600 or more you will receive a 1099 tax form with your check.

This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but still have to report the income otherwise youll receive filing penalties.

. This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i. Amazon branded safety vests and window clings are available to all drivers. Every day we invest in technology and operational improvements to make delivering even safer.

Have a mid-size or larger vehicle. Just made the cutoff 1 Continue this thread More posts from the AmazonFlexDrivers community 178 Posted by 5 days ago Tampa. My question is as follows in relation to Amazon Flex and claiming mileage.

On Tuesday the FTC said the payments will go out as checks or via PayPal. Driving for Amazon flex can be a good way to earn supplemental income. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare.

NEC stands for nonemployee compensation. I already work a normal 9-5 job and pay tax and NI through PAYE. Increase Your Earnings.

If you get a PayPal payment please accept it within 30 days. Be 21 or older. We have a passionate team that ensures Delivery Partners can operate their delivery businesses as safely as possible.

Payee and received nonemployee compensation totaling 600 or more Amazon is required to provide you a 1099-NEC form as well as report these amounts to the IRS. So you get social security credit for it when you retire. You can find your Form 1099-NEC in Amazon Tax Central.

Schedule C is included with and part of your personal tax return Form 1040. In order to fulfill the IRS requirements as efficiently as possible answer all questions and enter all information requested during the interview. It does the same thing and doesnt change your taxes.

If you are a US. Actual earnings will depend on your location any tips you receive how long it takes you to complete your deliveries and other factors. If youre looking for a place to discuss DSP topics head over to ramazondspdrivers.

This is a newer form thats now used in place of the old Form 1099-MISC. You should report this income on your 2021 tax return. If you get a check please cash it before January 7 2022.

The agency urged affected Amazon Flex drivers to deposit or cash their checks before Jan. You use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you closer to your goals. To be eligible you must.

Gig Economy Masters Course. Here are some of the most frequently-received 1099 forms received by Amazon drivers. Free e-filing tools are available at wwwirsgovfreefile.

Ago If you make under 600 then you dont need to file it for taxes and thats why your not seeing the 1099 form 4 level 2 Op 2 yr. Actual earnings will depend on your location any tips you receive how long it takes you to complete your deliveries and other factors. This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program.

Its almost time to file your taxes. Im in NYC and havent got it too. Have a valid US.

Ago Tucson Thank you. The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or 1042-S reporting. Internal Revenue Service regulations require Amazon to post your 1099 by January 31st.

I have recently started doing part time work with Amazon Flex this basically for tax purposes makes me a self employed contractor. A 1099 form is a tax form issued by a company in this case Amazon Flex to an individual that is not an employee you an Amazon Flex driver that explains how much was paid in compensation for a service provided during the tax year. What is Amazon Flex.

Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité. I am aware that being classed as self employed means I will need to fill. You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040.

Most drivers earn 18-25 an hour. The health and safety of Amazon Flex drivers is our number one priority. Form 1099-NEC is used to report nonemployee compensation eg.

You pay 153 for 2017 SE tax on 9235 of your Net Profit greater than 400. 7 2022 and said that drivers. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on.

Form 1099-NEC is replacing the use of Form 1099-MISC. Knowing your tax write offs can be a good way to keep that income in your pocket.

Filing A W 2 And 1099 Together A Guide For Multi Income Workers

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How To File Robinhood 1099 Taxes

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Are Legal Settlements Taxable What You Need To Know

Penalties For Missing 1099 Forms And How To File Late

What Is A 1099 Form What Freelancers Need To Know

Do You Have To File 1099 Taxes If You Made Less Than 600

![]()

Triplog Automatic Mileage Tracking Made Easy

Common Tools Can Save You Time Money On Taxes Nerdwallet Electronic Filing System Tracking Mileage Save Yourself

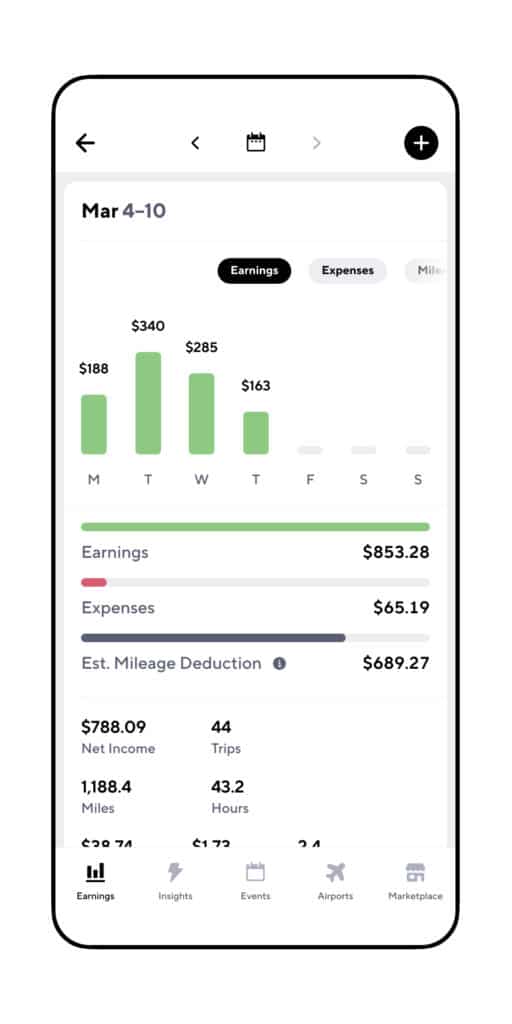

The Best Ways To Track Gig Driving Miles For Taxes Gridwise

What Happens If You Miss A Quarterly Estimated Tax Payment

2021 Daily Income Mileage Toll And Taxes Tracker For Etsy In 2022 Daily Expense Tracker Rideshare Income

What To Do With Your Amazon 1099 K Amazon Done With You Selling Online

Amazon Flex Filing Your Taxes Youtube

Fuy Bill Bluetooth Speaker Pth 305 Wireless Stereo Music Sound Box Support Fm Radio Line In Tf Time Alarm Clock Altavoz Speakers Sound Boxes Fm Radio Bluetooth Speakers Portable

Am I Individual Or Sole Proprietor For Payable 1099 Doordash Instacart